Monday, January 31, 2011

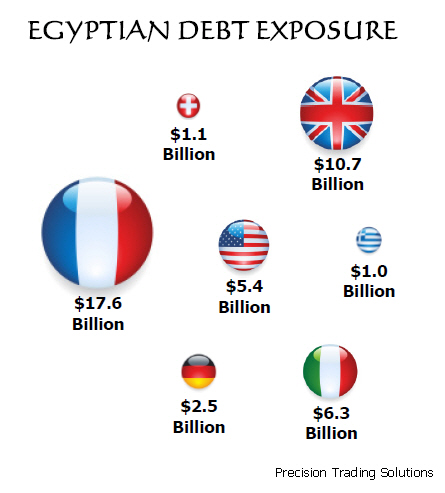

Egyptian Exposure

Sunday, January 30, 2011

Friday, January 28, 2011

India Food Prices Continue to Rise

Ten Countries on the Verge of Demographic Crisis

Pakistan: $167 Billion GDPPopulation change by 2040: +38%Median age in 2010: 21.3Median age in 2040: 29.4Birth rate: 65 out of 223

Pakistan is rapidly becoming the fourth most populous country in the world, but that does not make it one of the BRICs. Far more than neighbors India and China, Pakistan lacks the infrastructure for educating its surging population and the economy for employing them. "Time is running out to put appropriate policies in place. The absence of this may result in large-scale unemployment and immense pressure on health and education systems. In short, a socio-economic crisis may take place, making the demographic dividend more of a demographic threat,” said Durr-e-Nayab of the Pakistan Institute of Development Economics.

Egypt: $188 Billion GDPPopulation change by 2040: +32%Median age in 2010: 23.9Median age in 2040: 32.8Birth rate: 69 out of 223

Egypt has more than twice the GDP per capita of Pakistan, but just about the same birth rate, median age, and blazing population growth. The rising population threatens to overwhelm the emerging economy, causing a rise in unemployment, pollution, disease, and unrest. Already there are not enough jobs for the half-million Egyptians that join the job market each year, according to the AFP.

Extreme population density is another problem."Egypt, outside the desert, has the highest population density in the world, with 2,000 inhabitants in every square kilometre, twice that of Bangladesh," said population specialist Philippe Fargues of the American University in Cairo.Saudi Arabia: $380 Billion GDPPopulation change by 2040: +54%Median age in 2010: 24.6Median age in 2040: 33.8Birth rate: 51 out of 223

The quintessential job for a Saudi man used to be an executive position in state-sponsored company, with a big pay check and very little work. But there are only so many jobs the Sultan can give away. With the population growing at a third-world rate, the government is struggling to diversify the economy away from petroleum, according to the CIA World Factbook.

"In a country with a young demographic profile—those below 30 make up over 60 percent of the population—the need for change has not been as strong for quite some time, and yet the current situation forebodes a rare combination of both challenges from a long time past and a unique opportunity to confront them," said Hassan Hakimian, an economist at the Cass Business School.Ukraine: $116 Billion GDPPopulation change by 2040: -21%Median age in 2010: 39.5Median age in 2040: 46.6Birth rate: 202 out of 223

Low birth rate and high emigration rates are the story throughout eastern Europe. Ukraine stood out for its rate of population decline, which is the highest of all developing countries, according to the CIA World Factbook. Former President Viktor Yushchenko saw an even more dire picture when he warned Ukraine could lose half of its population by 2050, according to Ukraine news site ForUm.

South Korea: $800 Billion GDPPopulation change by 2040: -2.5%Median age in 2010: 37.9Median age in 2040: 51.0Birth rate: 212 out of 223

South Korea is swiftly catching up to Japan in terms of old populations with dismal birth rates. As such it may be heading toward its own lost decades: stagnation, labor deficits, and burdensome pensions and health care. Meanwhile, North Korea is turning out babies at a quick rate, which has scary implications for the island balance of power.

"The challenge facing Korea is especially daunting, and quite simply no other society at a similar stage of development faces an age wave that is as massive as Korea's, or as fast-approaching," said Keisuke Nakashima, a researcher at the Center for Strategic and International Studies.

Google Update

How Bad is a $1.5 Trillion Deficit?

View from Davos: How Bad is a $1.5 Trillion Deficit?Posted by STEPHEN GANDEL Thursday, January 27, 2011 at 12:38 pm

Joseph Stigliz is one of the many economists talking about debt at Davos.

Now that we have the recovery, we will have to pay for it. The question is did we take the appropriate measures or did we overspend.

On Thursday, the CBO estimated that the federal deficit in 2011 will reach nearly $1.5 trillion. That's up from nearly $1.3 trillion last year. Three years after the financial crisis many had hoped what were supposed to be temporary budget deficits would be shrinking by now. That's especially true because early bailout measures like TARP ended up mostly paying for itself.

So why is the deficit still rising? It's because the recession has turned out to be weaker than many expected, and unemployment has stayed high. The tax cut passed late last year, which some called a second stimulus, will alone add $400 billion to the debt this year. Here in Davos, where business and political leaders are meeting for the World Economic Forum, there are two views on debt that are being expressed. And at least one of them seems to suggest the recent run up in US deficits aren't that bad. Here's why:

The first view on debt is the obvious one. Perhaps, in part, because the World Economic Forum is located, conversations here and panel discussions are dominated by the European fiscal crisis. And the situation in Europe seems bad. Greece, Ireland and others have borrowed so much that many are worried they won't be able to pay back their debts. The UK's austerity measures may be causing that country to slip back into recession. Some are saying the Euro will have to be abandoned.

On that backdrop, the US debt seems bad. At a dinner of economists on Wednesday night, economist Carmen Reinhart predicted that the US was headed toward a crisis where we would be forced to cut many of our social services. Raghuram Rajan, a former chief economist at the IMF, said that the measures that the UK were making to deal with their deficit right now were a good move. He said we too should deal with our fiscal problems now, rather than putting them off.

But not everyone thinks the US debt problem is so dire. While the total deficit is larger this year than last year, it is slightly smaller as a percentage of GDP than last year. What's more, the US many have more ability to borrow than other countries because of the dominant role of the dollar in the world economy. The fact that our dollars are so widely seen as a safe asset gives America the ability to borrow more than say Greece or Ireland before hitting the breaking point. Nobel prize winning economist Joseph Stiglitz, who is also at Davos, said that while he is worried about some of the US states debt problem, he thinks debt may not be as bad as some people think. In fact, Stiglitz would even be for increasing our debt even more. As long as it was spent on things like infrastructure and education, which can produce jobs, and boost incomes. So there is a debt cliff, but the US may not be there yet.

Thursday, January 27, 2011

Eyes on Gold

We are watching gold very closely today as it approaches a major trend line that goes back to early 2010. The longer trend, which goes back to late 2008, has already given way. However this flatter trend is still in tact. If gold breaks decisively below this trend line and closes below $125 (GLD), we would likely swap our long position to a short position. We do not hold cash, which means when an investment is no longer consider a buy, it then becomes a sell and we take a short position immediately. There are a number of other signals that GLD may be weakening at these levels. Although gold has sold off recently, the trends have still been fully intact until now. The long term fundamentals for gold remain strongly bullish, however there is substantial room for a pullback at some point. We would not hesitate to reverse to a long position quickly if gold strengthens, as the longer term direction is still up.

We are watching gold very closely today as it approaches a major trend line that goes back to early 2010. The longer trend, which goes back to late 2008, has already given way. However this flatter trend is still in tact. If gold breaks decisively below this trend line and closes below $125 (GLD), we would likely swap our long position to a short position. We do not hold cash, which means when an investment is no longer consider a buy, it then becomes a sell and we take a short position immediately. There are a number of other signals that GLD may be weakening at these levels. Although gold has sold off recently, the trends have still been fully intact until now. The long term fundamentals for gold remain strongly bullish, however there is substantial room for a pullback at some point. We would not hesitate to reverse to a long position quickly if gold strengthens, as the longer term direction is still up.We made a call on shorting silver back on January 13th, and since that point SLV is down 6% (let's not count our money just yet). Sliver and gold do not always trade in tandem, which is why we analyze those metal separately. Silver also has outperformed by a significant margin, and therefore has more room to correct.

Below is a weekly chart of gold, which is available in our member section along with daily commentary and real-time updates on trading decisions.

UPDATE: Friday 1/28 - Gold has strengthened today and is holding above the uptrend line.

Wednesday, January 26, 2011

Why The Future Is So Clear

We need to step way back and look at how this system is setup. Our entire society is based on short-term results. Whether it is companies that focus on quarterly earnings, investors that move stock prices based on short-term news events, or politicians that are only in office four years before facing re-election, in every case those in power must focus on short term results, or they will be replaced with someone that will.

We need to step way back and look at how this system is setup. Our entire society is based on short-term results. Whether it is companies that focus on quarterly earnings, investors that move stock prices based on short-term news events, or politicians that are only in office four years before facing re-election, in every case those in power must focus on short term results, or they will be replaced with someone that will. src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

Now, can you imagine President Bush telling the American people that neither he, nor the Fed, were going to artificially stimulate the economy because they did not want to create a bubble? Can you imagine a President saying that it was up to the people and the free market to heal on their own, and that the government was going to step aside and let the market work? Of course not, so the Fed and the government pumped money into the economy and fixed rates at all-time lows to try and bring us out of the post-911 malaise. Well, it worked, and they managed to create a wonderful situation were housing prices went straight up for a number of years. Unemployment dropped, jobs came back, and everything was perfect. Until of course 2008, when it became clear that the “free money” environment was a breading ground for unusual risk taking by the banks and brokers. Once the bubble burst, we came crashing down to reality. Home prices and equity prices corrected and credit froze up. We found ourselves using terms like “Great Depression II” and facing unemployment the likes of which our generation had never seen before.

Now, can you imagine President Bush telling the American people that neither he, nor the Fed, were going to artificially stimulate the economy because they did not want to create a bubble? Can you imagine a President saying that it was up to the people and the free market to heal on their own, and that the government was going to step aside and let the market work? Of course not, so the Fed and the government pumped money into the economy and fixed rates at all-time lows to try and bring us out of the post-911 malaise. Well, it worked, and they managed to create a wonderful situation were housing prices went straight up for a number of years. Unemployment dropped, jobs came back, and everything was perfect. Until of course 2008, when it became clear that the “free money” environment was a breading ground for unusual risk taking by the banks and brokers. Once the bubble burst, we came crashing down to reality. Home prices and equity prices corrected and credit froze up. We found ourselves using terms like “Great Depression II” and facing unemployment the likes of which our generation had never seen before.  We have a world now that is beginning to face the reality of the consequences of this unprecedented stimulus. Inflation is beginning to show in food and energy. The problem is that our economy is not recovering in a healthy, strong manner. The American people, the voters, are not happy. They are demanding that something be done by the government to fix this problem. Even if those in power understood the risks of more stimulus and monetary easing, they simply have no choice but to continue to pump money into the system so they can show short term results. If they tell the American people that they are just going to have to “take their medicine” because any further stimulus will risk full economic collapse, they will not be in power for long.

We have a world now that is beginning to face the reality of the consequences of this unprecedented stimulus. Inflation is beginning to show in food and energy. The problem is that our economy is not recovering in a healthy, strong manner. The American people, the voters, are not happy. They are demanding that something be done by the government to fix this problem. Even if those in power understood the risks of more stimulus and monetary easing, they simply have no choice but to continue to pump money into the system so they can show short term results. If they tell the American people that they are just going to have to “take their medicine” because any further stimulus will risk full economic collapse, they will not be in power for long.There is one thing that can break this cycle. If the world wakes up and realizes the disastrous mess we have created, they will then lose confidence in our system. When that happens, we will all be forced to take our medicine. Unfortunately, we will be taking that medicine not only for our own mistakes, but for the mistakes of previous generations as well. The good news is that all we will have left to build our society back up is the free market, and that is all we will need.

Fed Decision

WASHINGTON (AP) -- The Federal Reserve said Wednesday that the economy isn't growing fast enough to lower unemployment and must press ahead with its $600 billion Treasury bond-purchase program.Ending its first meeting of the year, the Fed made no changes to the program. The decision was unanimous.The decision came from a new lineup of voting members that includes two officials who have criticized the bond purchases. They have said the purchases could eventually ignite inflation or speculative buying in assets like stocks.The bond-buying program is intended to lower rates on loans and boost stock prices, spurring more spending and invigorating the economy. Chairman Ben Bernanke faces the challenge of trying to boost hiring and growth without creating new economic threats.

>> Continue reading

The Truth on Trade

Gold, More Relevant Than EverJanuary 25, 2011Charles KadlecThe Daily Reckoning

When Chinese President Hu Jintao visited the White House Wednesday, President Obama made sure to raise the contentious issue of currency values and press the Chinese leader to allow the renminbi to rise against the dollar. Not least among the reasons given was China’s $226 billion trade surplus with the US.

The problem: The Obama administration’s weak dollar policy is based on official trade data that grossly misrepresent the bilateral trade balance between two countries. According to the World Trade Organization (WTO), the actual US trade deficit with China is less than half the official number, or less than $115 billion.

The official trade data are based on a 19th-century world in which it was reasonable to assume that goods, from wine to machinery, were produced in a single country. If a bottle of French wine were imported to the US, the entire cost of the wine was credited to France in the calculation of the US-France trade balance.

While that simplified view of trade generally still holds for trade in agricultural products such as wine, it no longer reflects the 21st-century reality of global supply chains in all things manufactured.Take, for example, the case of the Apple iPhone. Using the 19th-century approach, the entire $178 estimated wholesale cost of the iPhone is credited to China, because that is the place of final assembly. As a consequence, imports of the iPhone in 2009 contributed $1.9 billion to the US trade deficit with China.In other words, official trade data imply that the invention of the iPhone has cost the US jobs, reduced our competitive position and made us poorer relative to the Chinese. That alone should cause any policy-maker to question the use of trade data in the development of international economic policies.Here is what they would find: What the 19th-century approach ignores is that Chinese workers contribute only $6.50 to the value of the phone. According to a study by Yuqing Xing and Neal Detert of the Asian Development Bank Institute (ADBI), this is far less than the value add provided by Japan ($60.60), Germany ($28.85), South Korea ($22.96) or the US ($10.75).When the value add from the US is taken into account, every iPhone imported into the US in 2009 actually contributed $4.25 to the US trade balance with China – the difference between the $10.75 of parts China imported from the US and the $6.50 in payments received for assembling the iPhone. That turns the $1.9 billion iPhone trade deficit with China using official trade data into a $48 million trade surplus.>> Continue reading

Roubini at Davos

Tuesday, January 25, 2011

How to Play the Food Crisis & Oil

Those that are regulars to our blog certainly know by now that there is a food crisis looming across the globe. Food prices have already begun to rise, along with energy prices, which dramatically affect the cost of producing food. The good news is that each and every investor can now protect themselves from these risks by hedging their exposure to these key areas, right in their own personal investment accounts. In fact, if things get out of control, these investment will appreciate and allow the investor to earn a return that can help them care for their family during difficult times.

Those that are regulars to our blog certainly know by now that there is a food crisis looming across the globe. Food prices have already begun to rise, along with energy prices, which dramatically affect the cost of producing food. The good news is that each and every investor can now protect themselves from these risks by hedging their exposure to these key areas, right in their own personal investment accounts. In fact, if things get out of control, these investment will appreciate and allow the investor to earn a return that can help them care for their family during difficult times. Precision Trading Solutions provides charts that follow both Agriculture and Oil for our members. We use DBA - PowerShares DB Agriculture Fund as our investment product for exposure to agriculture, and OLO - PowerShares DB Crude Oil Long as our vehicle for Oil. Both of these products offer fantastic exposure to these segments of the economy. Any investor with a brokerage or investment account can invest in these products.

Precision Trading Solutions provides charts that follow both Agriculture and Oil for our members. We use DBA - PowerShares DB Agriculture Fund as our investment product for exposure to agriculture, and OLO - PowerShares DB Crude Oil Long as our vehicle for Oil. Both of these products offer fantastic exposure to these segments of the economy. Any investor with a brokerage or investment account can invest in these products.>> View Fact Sheet for DBA

>> View Fact Sheet for OLO

Monday, January 24, 2011

Hard Truth on Hunger

Please note that India is considered to be in the "alarming" category! If India cannot get this situation under control, the consequences will spread across the globe, that much is certain.

Below are a few excerpts from the BBC article.

"We have 20 years to arguably deliver something of the order of 40% more food; 30% more available fresh water and of the order of 50% more energy."We can't wait 20 years or 10 years indeed - this is really urgent."Professor Beddington commissioned the study and was among the first to warn of "a perfect storm" of a growing population, climate change and diminishing resources for food production.The report says that "piecemeal" changes are not an option: "Nothing less is required than a redesign of the whole food system to bring sustainability to the fore."It calls for protection of the poorest from sharp price increases through government intervention and greater liberalisation of the trade in food in order to offset market volatility.

>> Full Article

Google is a Short

Sunday, January 23, 2011

Unemployment Uncovered

Only 47% of working age Americans have full time jobs

January 23, 2011

The Automatic Earth

Ilargi: VK, roving reporter for The Automatic Earth, has been playing with the numbers from the January 7 employment report issued by the U.S. Bureau of Labor Statistics. It seems valuable to look at unemployment from this, a different, angle. Some of it may even surprise you.

The total non institutional civilian labor force (Americans 16 years and older who are not in a institution -criminal, mental, or other types of facilities- or an active military duty) is reported as 238.889 million. Of these, we see:

Employed: 139.206 million people (58.3% of labor force)

Unemployed: 14.485 million people (6.1% of labor force)

Obviously, that can't be the total picture, we're only at 64.4%. This is why:

Part time employed for economic reasons: 8.931 million people. This concerns people who want a full-time job but can't get one.

Part time employed for non-economic reasons: 18.184 million people. Non-economic reasons include school or training, retirement or Social Security limits on earnings, but also childcare problems and family or personal obligations.

But the by far largest category "missing" from both the Employed and Unemployed statistics is the "Not In Labor Force": 85.2 Million people.

The BLS definition states: "Not in the labor force (NILF). A person who did not work last week, was not temporarily absent from a job, did not actively look for work in the previous 4 weeks, or looked but was unavailable for work during the reference week; in other words, a person who was neither employed nor unemployed." (Clearly, this does include lot of unemployed people).

To summarize: 108.616 million people in America are either unemployed, underemployed or "Not in the labor force". This represents 45.5% of working age Americans.

If you count the "Part time employed for non-economic reasons", you get 126.8 million Americans who are unemployed, underemployed, working part time or "Not in the labor force". That represents 53% of working age Americans.

So only 47% of working age Americans have full time jobs. While the official unemployment rate is 9.4%. Something's missing somewhere.

A few more factoids on the topic:

Today, the long term unemployed make up 42% of total unemployed. That is to say, of course, those who are actually counted as unemployed instead of "Not in the labor force".

43.2 million Americans receive foodstamps. That's 18.1% of all working age Americans. If they all have on average 1.5 dependents, which is probably a reasonable estimate, a full one third of the US population receives at least part of their food through this system.

Of course, these are not really stamps anymore, or any sort of paper, they’re now "food stamp debit cards". Michael Snyder at Economic Collapse dug up an ABC News article from April 2009, which deals with the fact that JPMorgan Chase is one of the main servicers of the "food stamp debit cards" (in 26 states). JPMorgan also services child support debit cards (in 15 states) and unemployment insurance cards (7 states).

Granted, some things may have changed somewhat since the article was written, but even just the very ideas that are the foundation of schemes like these are worth looking at. Because, naturally, JPMorgan does this to make a profit. Says ABC:

Take Indiana. JP Morgan gets 62 to 64 cents for each food stamp case handled monthly there. With 296,245 cases right now, that means the state is paying JP Morgan $183,672 a month on top of any other fees it collects. Indiana eliminated 100 full-time employees when it hired JP Morgan to make the program cost-neutral.

But the greatest statement the article makes, and the reason ABC looked into this in the first place, is that JPMorgan outsourced its call and service centers for the "food stamp debit cards" to India. If that isn't indicative of the level to which ethics and morals have sunk, I don't know what is. You could conceivably create a lot of jobs for Americans in these service centers, which would get them off food stamps! For starters.

Simply Unsustainable

_________________________________________________

None of us would be surprised by a high-3% number for GDP this quarter, and 4% is not out of the question. And we all see GDP tailing off as the year winds down. Inventory builds begin to slow, and in 2012 the 2% payroll holiday goes away. Plus, as I have written and David has noted, the pressure on state and local spending is getting larger with every passing day.

State and local spending is the second biggest component of the economy. The chart below, from David’s letter this week, gives us a visual image of just how large it is. Note that budget deficits at the state and local levels total more than 1% of GDP. Revenues, though, are still off 10% (on average) from where they were at the peak. The “fiscal stimulus” from the US government has run out and states and local communities are having to balance their budgets the old-fashioned way – through spending cuts and increased taxes.

As this budget cutting works its way through the economy, and as inventories are no longer being built (they are already at adequate levels), the growth from the current stimulus (both QE2 and payroll and federal government expenditures) the economy will have to stand on its own in terms of organic growth. And as the year wears on it will become apparent there is less true organic growth than currently meets the eye.

>> Full Article

Friday, January 21, 2011

Watching Google Closely...

Google is one of the stocks we are analyzing in our guest section during January. Take a look at what we are seeing....

Russia to Raise Gold Share in Reserves

Russia to Raise Gold Share in Reserves, Eyes Adding Yuan, Ulyukayev Says

By Maria Levitov - Jan 20, 2011 11:45 AM CT

Russia’s central bank will raise the share of gold in its international reserves, the world’s third largest, from about 8 percent, First Deputy Central Bank Chairman Alexei Ulyukayev said.

"We’ve increased our investment in gold during the last several years and we will continue to move in the same direction in the future," he said in an interview in London. "Gold is a natural part of reserves."

Russia, which aims to diversify its reserves, started adding the Canadian dollar and plans to invest in the Australian dollar. The central bank has almost doubled the share of gold in the past three or four years, according to Ulyukayev. The stockpile comprises 47 percent U.S. dollars, 41 percent euros, 9 percent British pounds, 2 percent Japanese yen and 1 percent Canadian dollars, according to the central bank.

The bank won’t begin to add the Australian dollar until the middle of the year, Ulyukayev said on Dec. 1. Policy makers may also add new currencies to the reserves, with the Chinese yuan a potential target once it becomes fully convertible.

"We are trying our best to diversify the reserves" and investing in managed currencies is difficult, Ulyukayev said today. "If the capital control regime will be changed, in the People’s Republic of China in this case, we can invest in that currency also."

To contact the reporter on this story: Maria Levitov in Moscow at mlevitov@bloomberg.netTo contact the editor responsible for this story: Gavin Serkin at gserkin@bloomberg.net

Source: Bloomberg

How The Recession Changed Us

Thursday, January 20, 2011

Unemployment - A Closer Look

Wednesday, January 19, 2011

Why It Doesn't Feel Like a Recovery

Housing's Next Leg Down

GET READY FOR ANOTHER HOUSING CRASHJohn Carney, Senior Editor, CNBC.comJanuary 18, 2011The best evidence that we're headed for a double-dip in housing is the quality of the mortgages during the recent period in which the housing market seemed to improve in many areas.

In the Freddie Mac review of Citigroup’s performing loans that I mentioned earlier today, the portion rated as “Not Acceptable Quality” was as high as 32 percent in the fourth quarter of 2009. While this has obvious implications for the repurchase or "put-back" liability of Citigroup, it also has broader implications for the housing market and the economy.

Keep in mind that the quarter in which Citi was churning out the highest amount of flawed mortgages was supposedly a good time for housing. The median price of previously owned single-family homes in the fourth quarter of 2009 rose in 67, or 44 percent, of the 151 metropolitan areas, according to a survey by the National Association of Realtors. Sixteen of the areas posted double-digit increases. The Case-Schiller numbers for that quarter showed U.S. home prices were trending up in 155 out of 384 metro areas.

Now there have been indications in the past that a mini-housing bubble was being built during that period. The Federal Housing Authority, for instance, was backing some very questionable loans. The home-buyer tax credit was allowing individuals to buy loans with no money down. All the bad practices of the 2005-2007 bubble seemed to be back again.

And now we know that this perception was correct. Mortgage quality had fallen off a cliff. If Citigroup's mortgages were this bad, we can expect the same level of problems at Wells Fargo, Bank of America and every other major US mortgage lender.

The best evidence that we're headed for a double-dip in housing is the quality of the mortgages during the recent period in which the housing market seemed to improve in many areas.

In the Freddie Mac review of Citigroup’s performing loans that I mentioned earlier today, the portion rated as “Not Acceptable Quality” was as high as 32 percent in the fourth quarter of 2009. While this has obvious implications for the repurchase or "put-back" liability of Citigroup, it also has broader implications for the housing market and the economy.

Keep in mind that the quarter in which Citi was churning out the highest amount of flawed mortgages was supposedly a good time for housing. The median price of previously owned single-family homes in the fourth quarter of 2009 rose in 67, or 44 percent, of the 151 metropolitan areas, according to a survey by the National Association of Realtors. Sixteen of the areas posted double-digit increases. The Case-Schiller numbers for that quarter showed U.S. home prices were trending up in 155 out of 384 metro areas.

Now there have been indications in the past that a mini-housing bubble was being built during that period. The Federal Housing Authority, for instance, was backing some very questionable loans. The home-buyer tax credit was allowing individuals to buy loans with no money down. All the bad practices of the 2005-2007 bubble seemed to be back again.

And now we know that this perception was correct. Mortgage quality had fallen off a cliff. If Citigroup's mortgages were this bad, we can expect the same level of problems at Wells Fargo, Bank of America and every other major US mortgage lender.

What does this mean for housing? It implies that home prices may be due for a another crash, as lenders try to avoid incurring losses from mortgage put-backs by raising credit quality once again. Much of the supposed health of the housing market may have been just another easy money illusion.

We may be able to avoid a crash if the economy improves rapidly enough to take up the slack created by the loose lending. Alternatively, more cheap money flowing from the Fed through the banks and into shoddily underwritten mortgages, could keep the bubble inflating for a while longer (and maybe, fingers crossed, the economy will improve and rescue housing.) And if a crash occurs it will likely not be as severe as the last one, simply because the improvements in the housing market in 2009 and 2010 were modest.

But one thing seems certain: much of the improvement in housing over the last two years was built on easy credit.

We may be able to avoid a crash if the economy improves rapidly enough to take up the slack created by the loose lending. Alternatively, more cheap money flowing from the Fed through the banks and into shoddily underwritten mortgages, could keep the bubble inflating for a while longer (and maybe, fingers crossed, the economy will improve and rescue housing.) And if a crash occurs it will likely not be as severe as the last one, simply because the improvements in the housing market in 2009 and 2010 were modest.

But one thing seems certain: much of the improvement in housing over the last two years was built on easy credit.

Source: cnbc.com

Tuesday, January 18, 2011

Year of the "Food Crisis"

In Corrupt Global Food System, Farmland Is the New Gold

By Stephen Leahy

UXBRIDGE, Canada, Jan 13, 2011 (IPS) - Famine-hollowed farmers watch trucks loaded with grain grown on their ancestral lands heading for the nearest port, destined to fill richer bellies in foreign lands. This scene has become all too common since the 2008 food crisis.

Food prices are even higher now in many countries, sparking another cycle of hunger riots in the Middle East and South Asia last weekend. While bad weather gets the blame for rising prices, the instant price hikes of recent times are largely due to market speculation in a corrupt global food system.

The 2008 food crisis awoke much of the world's investment community to the profitable reality that hungry people will do almost anything, even sell their own children, in order to eat. And with the global financial crisis, food and farmland became the "new gold" for some of the biggest investors, experts agree.

In 2010, wheat futures rose 47 percent, U.S. corn was up more than 50 percent, and soybeans rose 34 percent.

On Wednesday, U.S.-based Cargill, the world's largest agricultural commodities trader, announced a tripling of profits. The firm generated 1.49 billion dollars in three months between September and November 2010.

Meanwhile, U.S. Treasury Bills pay a return of less than one percent.

"We have set up a global food system that supports speculation. And with [such] markets, we can't get speculators out of the food business," said Lester Brown, an agricultural policy expert and founder of the Washington- based Earth Policy Institute.

"Farmland is better gold than gold for speculators," Brown told IPS.

Growing concern over access to food is also creating a new geopolitics around food security, with many countries buying up farmland and banning the export of food, he said.

World leaders have utterly failed to address the simple fact that while there is enough food, a billion people, living in every country in the world, simply can't afford to buy it, said Anuradha Mittal of the Oakland Institute, a U.S.-based policy think tank on social, economic and environmental issues.

"Why were a billion hungry with a record wheat harvest in 2008?" Mittal told IPS.

And how is it there are one billion people who are overweight, with 300 million of those considered medically obese?

The global food system is designed to generate profits not feed people, and nothing has changed since 2008, she said. "There has been no focus on how to achieve food security or on regulating the food trade," Mittal noted.

Instead, the World Bank, World Trade Organisation and other multilateral organisations are pushing for more production and more trade liberalisation, she said. That approach is exactly how Africa became unable to feed itself after being previously food secure.

"Africans have become share-croppers, exporting coffee, cotton, flowers and now food while going hungry," Mittal said.

Source: www.ipsnews.net

Vertical Farms of the Future

>> Read article and watch video via Global Macro Monitor

Monday, January 17, 2011

Apple - Still Long!!

Click >> View Charts

Memorable MLK Quotes

'Returning violence for violence multiplies violence, adding deeper darkness to a night already devoid of stars.... Hate cannot drive out hate: only love can do that.'“The ultimate measure of a man is not where he stands in moments of comfort and convenience, but where he stands at times of challenge and controversy.”

“I believe that unarmed truth and unconditional love will have the final word in reality. That is why right, temporarily defeated, is stronger than evil triumphant.”

“Hatred paralyzes life; love releases it. Hatred confuses life; love harmonizes it. Hatred darkens life; love illuminates it.”

“Let no man pull you low enough to hate him.”

“Injustice anywhere is a threat to justice everywhere.”

“I submit that an individual who breaks a law that conscience tells him is unjust, and who willingly accepts the penalty of imprisonment in order to arouse the conscience of the community over its injustice, is in reality expressing the highest respect for the law.”

“I submit to you that if a man hasn't discovered something he will die for, he isn't fit to live.”

“The good neighbor looks beyond the external accidents and discerns those inner qualities that make all men human and, therefore, brothers."

“We have been repeatedly faced with a cruel irony of watching Negro and white boys on TV screens as they kill and die together for a nation that has been unable to seat them together in the same school room.”

Source: Christian Science Monitor

Sunday, January 16, 2011

Cost of Raising Kids

Saturday, January 15, 2011

Friday, January 14, 2011

Student Loan Bubble

This issue has been on our minds for some time, but may be coming to a head. Every one of us has, at one time or another, had a discussion about the rising cost of a college education. We all know of private and public schools where the cost of just a four year undergraduate degree is about the same as the average home price in this country! How many of us stop to dig deeper and ask "why" this price increase continues while at the same time prices of almost everything else are falling as a result of the recession and credit crisis. Last time we

checked, falling demand leads to falling prices. Sure, there are select universities that are always in high demand. However those schools are in the minority when compared to the total number of universities across this country. Why do prices continue to rise across the board? We can all thank Uncle Sam for this situation. The federal student loan program is a great example of an idea that would seem to have tremendous benefits and very little costs. Who can argue against providing very cheap loans to almost any student

checked, falling demand leads to falling prices. Sure, there are select universities that are always in high demand. However those schools are in the minority when compared to the total number of universities across this country. Why do prices continue to rise across the board? We can all thank Uncle Sam for this situation. The federal student loan program is a great example of an idea that would seem to have tremendous benefits and very little costs. Who can argue against providing very cheap loans to almost any student so they can achieve their dream of getting a college education? Think of all the lower income students that would not have been able to afford a degree if not for our student loan program. Well, it's not that simple. Thanks to all this free money gushing from the faucet, universities have free

reign to continue to raise tuition rates across the board. Why not, students can just go out and get more loans to cover the increase. In fact, when enrollment falls, universities usually RAISE tuition to offset the budget shortfall! How many businesses do you know of that operate in that manner? All those students that fulfilled their dreams thanks to student loans are left with huge loans that if not handled perfectly can be a burden for their entire lives. This generation of college graduates now finds themselves in a very difficult situation. Very few jobs for recent grads, and mountains of student loans higher than any other generation in history!! Sound like a bad situation, well it is and it likely will not last forever.

reign to continue to raise tuition rates across the board. Why not, students can just go out and get more loans to cover the increase. In fact, when enrollment falls, universities usually RAISE tuition to offset the budget shortfall! How many businesses do you know of that operate in that manner? All those students that fulfilled their dreams thanks to student loans are left with huge loans that if not handled perfectly can be a burden for their entire lives. This generation of college graduates now finds themselves in a very difficult situation. Very few jobs for recent grads, and mountains of student loans higher than any other generation in history!! Sound like a bad situation, well it is and it likely will not last forever.Again, this is one of those perfect examples of how we have all been brainwashed just because we have lived with the status-quo our entire lives. "Student loans, of course they are a good thing. We have always had student loans. Anyone against student loans is crazy!" The federal government along with the big banks have created a situation that if left alone, would have functioned like many other free market industries. The quality of education should increase, while the cost should be decreasing. That is how any free-market works, just look at all kinds of examples such as technology. Far more students would have been able to go to college and would not have been saddled with any loans upon graduation.

This article from CommonDreams.org outlines the current situation. We have taken out a few key excerpts as a summary, but we recommend you read the entire article carefully.

A Primer on the Student Loan BubbleJanuary 11, 2011It was announced last summer that total student loan debt, at $830 billion, now exceeds total US credit card debt, itself bloated to the bubble level of $827 billion. And student loan debt is growing at the rate of $90 billion a year.______________________________The extraordinary growth of student debt paralleled the bubble years, from the beginnings of the dot.com bubble in the mid-1990s to the bursting of the housing bubble. From 1994 to 2008, average debt levels for graduating seniors more than doubled to $23,200, according to The Student Loan Project, a nonprofit research and policy organization. More than 10 % of those completing their bachelor’s degree are now saddled with over $40,000 in debt.______________________________There is about $830 billion in total outstanding federal and private student-loan debt. Only 40% of that debt is actively being repaid. The rest is in default, or in deferment (when a student requests temporary postponement of payment because of economic hardship), which means payments and interest are halted, or in forbearance. Interest on government loans is suspended during deferment, but continues to accrue on private loans.______________________________As tuitions increase, loan amounts increase, as do private loan interest rates, which have reached highs of 20%. Add that to a deeply troubled economy and dismal job market, and we have the full trappings of a major bubble. As it goes with contemporary bubbles, when the loans go into default, taxpayers will be forced to pick up the tab, since just about all loans extended before July, 2010 are backed by the federal government.______________________________Two out of every five students enrolled at proprietary schools are in default on their education loans 15 years after the loans were issued. In spite of this high extended default rate, for-profit colleges are in no danger of losing their access to federal financial aid because, as we have seen, the Department of Education does not record defaults after the first two years of repayment.______________________________According to the National Association of Colleges and Employers more than 50 % of all 2007 college graduates who had applied for a job had received an offer by graduation day. In 2008, that percentage tumbled to 26 percent, and to less than 20 % in 2009. And a college education has been producing diminishing returns. For while a college degree does tend to correlate with a relatively high income, during the last eight to ten years the median income of highly educated Americans has been declining.

UPDATE 8/22/2011 - Great article from The Atlantic on the explosion of student loan debt